Lark Funding is a prop trading firm, offering traders many funding options. This review will delve into the key features of Lark Funding, such as its evaluation process, account size options, profit-sharing model, and broker partnership. We'll also explore their trading platforms, available instruments, leverage choices, and customer support.

Lark Funding Review

Lark Funding, a recently established proprietary trading firm in the summer of 2022, offers a structured three-stage program designed to help traders attain funded trader status. The first phase of the program focuses on achieving a 5% account gain while maintaining a maximum drawdown of 5%. Phase 2 requires traders to aim for a 4% account gain while upholding the same maximum drawdown limit. Phase 3 represents the final leg of the program, with traders targeting a 3% account gain. Upon successful completion of all three phases, traders earn the funded trader status. This status comes with a substantial profit-sharing arrangement, with traders receiving 80% to 90% of their account gain. Additionally, traders have the option to engage in weekend trading, allowing them to maintain positions over the weekend at an additional cost of 10% of their challenge fee.

How Lark Funding Differs from Other Proprietary Firms?

In this section, we'll explore how some features of Lark Funding differ from other proprietary firms:

- Touchless Passing feature: It’s designed to streamline the evaluation process by eliminating the requirement to manually close trades for passing. When your floating balance reaches the account gain target, the system will automatically recognize it as a pass. This enables traders to focus on their trading strategies without the need for constant monitoring.

- Lark Funded Reset: For traders who have invested significant time and effort, potentially over years, a breach would mean having to start the entire evaluation process again. However, Lark Funding provides an alternative solution through the Lark Funded Reset option.

- The Lark Gain Protector: This feature enables traders to request a withdrawal from their Simulated Funded Account, even if they have exceeded the daily drawdown limit. To qualify for this feature, specific conditions must be met: traders should not have incurred a loss exceeding 1% of their account balance, and they should have a minimum of 5 trading days.

What Are the Advantages of Joining Lark Funding?

- Time Freedom: Lark Funding offers traders the benefit of no time constraints throughout all evaluation phases. This approach allows traders to focus on learning and refining their trading strategies without the pressure of strict deadlines.

- Account Size Versatility: Lark Funding recognizes the varying levels of experience and risk tolerance among traders. To accommodate this diversity, they provide a range of account sizes suitable for both novice and experienced traders. This flexibility enables traders to choose an account size that aligns with their financial capacity and risk preferences.

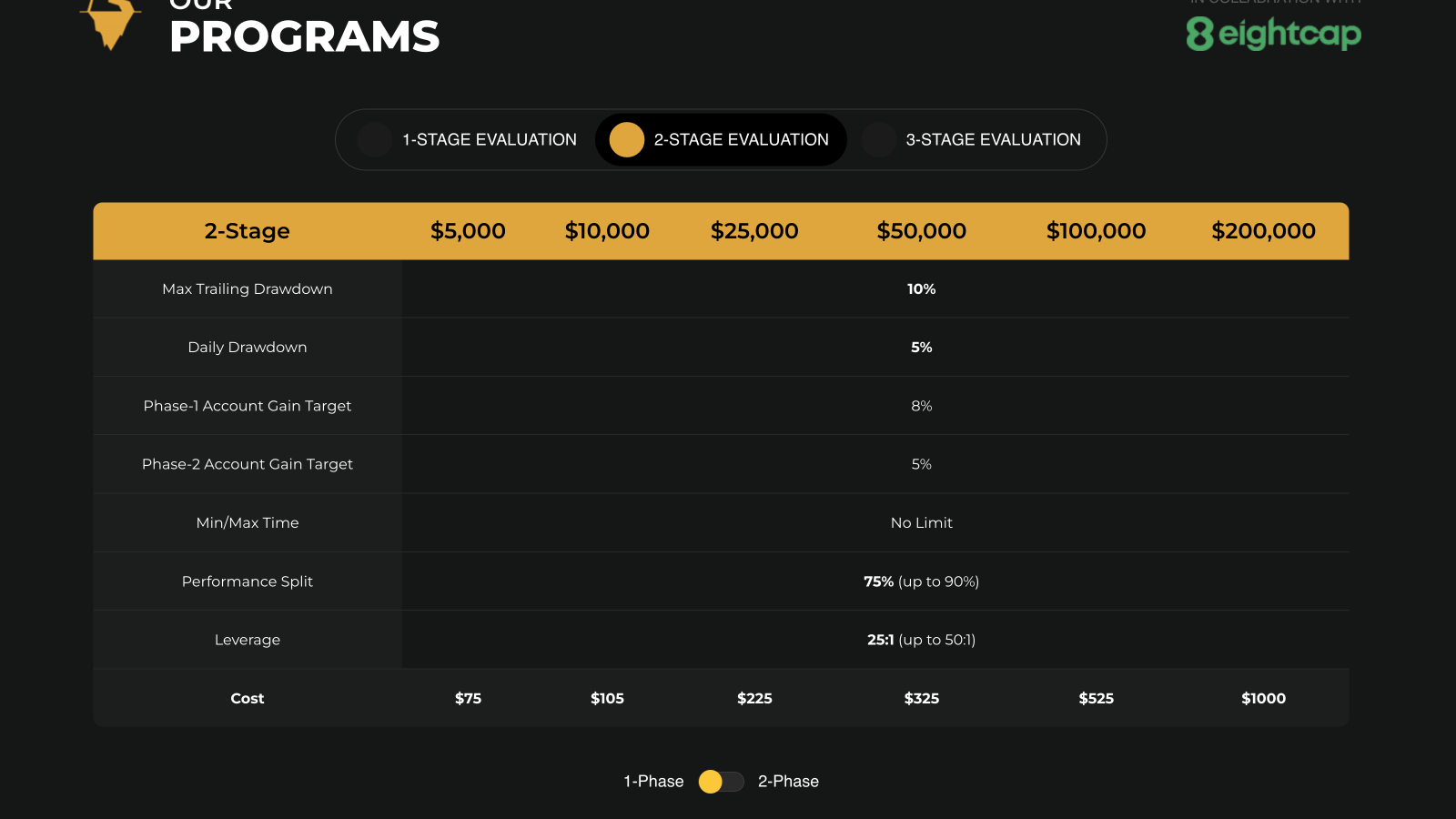

- Competitive Profit Sharing: Lark Funding implements an appealing profit-sharing model that enables traders to retain a significant portion of their trading profits. The profit split starts at 75% and has the potential to increase up to 90%, offering traders the opportunity for substantial earnings.

- Leverage Choices: During the funded phases, Lark Funding offers traders the option to select their desired leverage. This flexibility allows traders to potentially enhance their capital and adapt to their specific trading strategies.

- Gradual Evaluation Programs: Lark Funding utilizes a tiered approach to evaluation through its 1-stage, 2-stage, and 3-stage programs. This structured framework caters to traders with varying levels of experience and risk tolerance, ensuring that each trader can progress at their own pace and comfort level.

Broker Partnership

Lark Funding has established a partnership with Eightcap, a well-regarded brokerage firm known for its collaborations with various prop trading firms like FTUK and The Funded Trader. This partnership offers traders several advantages, including commission-free trading, low spreads, rapid trade execution, and competitive pricing.

Trading Platform

Lark Funding provides traders with a choice between two widely recognized trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are highly regarded in the trading community and offer a range of powerful tools for strategy development and decision-making. Traders also have access to a variety of add-ons, both free and paid, to enhance platform functionality. Whether traders prefer manual or automated trading, MetaTrader platforms offer versatile solutions. Additionally, MT5 users can benefit from the TradingView integration through Eightcap, allowing chart analysis and trading for funded accounts.

Trading Instruments

Eightcap provides traders with an extensive array of trading instruments spanning various asset classes, catering to diverse trading interests:

- Forex: Access over 40 major and minor forex pairs, facilitating a wide range of currency trading opportunities.

- Commodities: Trade in precious commodities such as Gold, Silver, and Oil, capitalizing on their price fluctuations.

- Indices: Engage in round-the-clock trading of the world's largest stock indices, enabling exposure to global markets.

- Stocks: Take positions, whether long or short, on prominent US, Australian, LSE, and XETRA stocks, diversifying your portfolio.

- Cryptocurrencies: Trade over 100 cryptocurrency derivatives, harnessing the volatility of digital assets for potential profits.

Trading Leverage

Lark Funding provides different leverage options based on account type and evaluation stage.

Regular accounts offer a 1:10 leverage for Forex, Metals, and Indices. Traders can double this to 1:20 by paying an additional 25% of the challenge cost during checkout. Equities have a standard leverage of 1:5, while cryptocurrencies offer a 1:2 leverage.

In the 2-Stage Evaluation process, Forex, Metals, and Indices have a leverage of 25:1, with the option to increase it to 50:1 by paying an extra 25% of the challenge fee during checkout. Equities maintain a 1:5 leverage, and cryptocurrencies stay at 1:2.

Customer Support

The primary means of communication for customer inquiries is via email. You can reach them at support@larkfunding.com for any questions, concerns, or assistance you may require. Their support team is prepared to respond promptly to emails.

Summary

Lark Funding has various features designed to cater to traders' needs. Whether you're a newcomer to trading or an experienced professional seeking new opportunities, Lark Funding provides a range of account sizes, competitive profit-sharing models, and leverage options to accommodate different preferences. With an extensive selection of trading instruments and a support team, Lark Funding is a potential option for traders.